Cut Costs and Improve Financial Work Order Quality Control with Instadesk Ticket System

The digital transformation in the financial industry is continuously advancing. Customer service tickets serve as an important communication bridge between institutions and customers, and they undertake key tasks such as answering inquiries, handling business, and resolving complaints. Financial business itself has extremely high requirements for professionalism and compliance. Ticket processing often requires coordination across multiple stages, and the handling of some complex tickets may take up to one month. During this period, multiple customer service representatives need to take turns to follow up and respond. Instadesk, leveraging advanced AI technology and rich industry experience, has developed an intelligent quality inspection solution specifically designed to address these issues, providing comprehensive support for the quality inspection of customer service tickets in the financial industry.

I. Core Pain Points of Quality Inspection of Customer Service Orders in the Financial Industry

1. Slow Real-time Performance and Incomplete Coverage

Financial customers have high expectations for the speed of service response and the effectiveness of problem resolution. Any compliance oversight or minor service flaws during the processing of the orders may make customers feel dissatisfied and even trigger compliance risks. The traditional manual sampling inspection method is limited by the cost of human resources and work efficiency, and can only cover a very small portion of the order data. Most orders are in an unmonitored state, making it difficult to ly identify and handle potential problems. Even if some institutions attempt to improve the quality inspection process, they often either sacrifice the detection timeliness to ensure data completeness or neglect the quality of the inspection for the sake of speed.

2. Unable to Guarantee the Integrity of Updated Data

Financial orders are not static files that remain unchanged. Various factors such as customer supplementary demands, business process advancement, and policy requirements adjustments will continuously update and change the order data. When new data is integrated, it is required that the quality inspection system can efficiently adapt and also needs to ensure that historical data is not disturbed. The integrity and coherence of the order information can be guaranteed. The traditional quality inspection system has insufficient flexibility in data processing. Either it cannot effectively integrate the new information, resulting in one-sided and incomplete detection results; or it will disrupt the relationships between historical data, causing the processing trajectory of the orders to break, making it difficult for financial institutions to grasp the complete process of order processing and unable to accurately define the responsibilities and service quality of each participant in the work that requires multiple customer service staff to collaborate.

3. Unable to Accurately Identify

Financial orders involve a large number of compliance points, including business-level compliance content such as interest rate expressions, risk warnings, product descriptions, and service-level compliance requirements such as service attitude, communication language, and privacy protection. The traditional quality inspection mode mainly relies on manual judgment and simple rule screening, which is difficult to handle complex semantic scenarios and flexible violation expressions. It is prone to missed detections and false detections. For example, in fund business orders, the answers to professional questions such as "withdrawal settlement time" and "subscription and redemption opening period" involve complex business rules and flexible expression methods. Manual quality inspection is difficult to ensure consistent and accurate judgment standards, and traditional small model quality inspection systems have problems of low detection accuracy and recall rate and limited coverage scenarios, unable to meet the needs of refined compliance management in the financial industry.

4. High Cost of Manual Quality Inspection

The traditional manual quality inspection mode requires a large number of professional quality inspectors. Not only is the cost of human resources high, but the work efficiency is also very low. Financial institutions generate a large number of orders every day, and manual quality inspection is difficult to achieve comprehensive coverage. Only sampling inspection can be adopted, which leaves a large regulatory blind zone. At the same time, manual quality inspection is prone to be influenced by subjective factors, and the judgment standards are difficult to be unified, resulting in missed detections and false detections. The objectivity and accuracy of the quality inspection results cannot be guaranteed. In addition, manual quality inspection cannot quickly process massive data and cannot extract valuable information such as customer needs and service shortcomings from the data, resulting in low data utilization efficiency and unable to provide strong support for the management decisions and service optimization of the institution.

5. Unable to Uniform Service Quality

Complex financial orders often require multiple customer service staff to cooperate in handling. The responses of different customer service staff in different stages together form the complete service process of the order. The traditional quality inspection mode mostly takes the entire order as the inspection unit and only gives a unified quality inspection result, which is difficult to accurately distinguish the compliance situation and service quality of each customer service staff's response. This leads to the ambiguity of responsibility when there are compliance issues or service complaints, making it impossible to effectively implement the assessment mechanism and unable to carry out targeted service optimization and personnel training.

II. Solution for the Financial Industry by Instadesk Ticket System

1. Innovative Technical Architecture

Instadesk Ticket System adopts an innovative technical solution of "real-time access + dynamic integration + end detection", which fundamentally resolves the industry problem of difficult balance between real-time performance and integrity. This system can obtain the reply content of customer service representatives in real time, automatically add the new content to the original work order conversation and generate a new conversation ID, and precisely match the quality inspection results to the last reply customer service representative. This not only ensures the real-time nature of the quality inspection but also realizes seamless integration of work order data. The system is equipped with an end detection operator model, which can intelligently identify the closing status of the work order and avoid repetitive detection of the same work order content. It ensures the accuracy of the detection results while balancing the efficiency of quality inspection, and perfectly adapts to the characteristics of long work order cycles and dynamic data updates in the financial industry.

2. Three-Model Fusion Technology

To meet the strict compliance requirements and complex semantic scenarios of the financial industry, Instadesk Intelligent Quality Inspection has built a three-model fusion quality inspection architecture of "regular model + NLP model + large model", and deeply integrates the technical capabilities of AI large models, significantly improving the accuracy and recall rate of quality inspection. The regular model can quickly screen out clear compliance key points and violation expressions, achieving efficient coverage of basic compliance detection; the NLP model has strong semantic understanding capabilities and can accurately identify hidden compliance risks and flexible and variable violation expression variants; the large model, with rich industry knowledge reserves and strong logical reasoning capabilities, can easily handle various complex business scenarios in the financial industry. For the complex quality inspection scenarios of fund business, Instadesk Ticket System builds an intelligent agent with nearly 50 nodes, ultimately achieving 100% quality inspection accuracy.

3. Adaptation to Multi-Party Collaboration Scenarios

In response to the characteristic of financial work orders requiring multiple customer service representatives to handle, Instadesk Intelligent Quality Inspection has specially optimized the work order quality inspection function, which can independently detect and evaluate the reply content of each customer service representative, generating exclusive quality inspection results for each participant in the work order handling. The system precisely locates the reply paragraphs of each customer service representative and the corresponding service links, combines preset compliance key points and service standards, and individually determine the compliance, accuracy and professionalism of the reply content, clearly defining the responsibility scope of each participating entity.

4. Full-Channel Multi-Modal Coverage

Instadesk Quality Inspection has powerful multi-modal data processing capabilities. It not only can efficiently handle the text data of financial customer service work orders, but also supports quality inspection of various data types such as voice, video, enterprise WhatsApp conversations, images, and documents, achieving full-channel coverage for supervision. In the financial service scenario, customer and customer service communication may cross multiple channels such as work orders, enterprise WeChat, phone calls, and videos.Instadesk Intelligent Quality Inspection can integrate communication data from these different channels into the quality inspection scope, forming a complete service data chain. The system can use image recognition and document analysis technologies to detect whether there are compliance risks such as privacy leakage or document tampering in work order attachments; with high-quality ASR technology, it can accurately transcribe voice calls into text, and then combine semantic analysis for compliance detection, perfectly adapting to the diversified service scenarios and complex quality inspection requirements of the financial industry.

5. Out-of-the-box and Continuous Optimization Service

Having deep ploughing the financial industry for many years,Instadesk Quality Inspection has accumulated over 50 industry standard quality inspection solutions, covering banking, securities, consumer finance, insurance and other sub-sectors, enabling out-of-the-box use, and financial institutions do not need to configure from scratch. For the common compliance points and service scenarios in financial work orders, the system has preset mature quality inspection models and rule libraries. Institutions can immediately use them to quickly implement the quality inspection work. At the same time, with the help of intelligent quality inspection, financial institutions can create exclusive quality inspection solutions tailored to their own characteristics. During the quality inspection process, the system will automatically collect multi-dimensional data such as customer needs, service issues, and compliance risks in the work orders. Through the deep analysis capabilities of the large model, these data will be labeled, classified, and insight-driven analyzed, helping institutions upgrade from a "passive compliance" state to an "active optimization" mode, forming a virtuous cycle.

III. Core Value of Instadesk Quality Inspection for the Financial Industry

1. Compliance Risk Control

Compliance is the foundation of the financial industry. With the help of intelligent quality inspection, full coverage and precise identification can be achieved. These two key advantages enable institutions to build a comprehensive compliance protection network. It can conduct 100% full-scale quality inspection, completely eliminating regulatory loopholes. The architecture combining the three models mentioned earlier can penetrate complex language expressions and accurately identify various compliance risks. In addition, the multi-level risk mechanism can handle problems at different levels, intercepting 90% of violations, effectively avoiding related losses, and allowing institutions to operate steadily under strict supervision.

2. Optimization of Service Quality

High-quality customer service is the key for financial institutions to build customer trust and enhance brand competitiveness. Instadesk Quality Inspection will independently review each customer service representative's work order responses and provide precise ratings, clearly pointing out the shortcomings and highlights in the service. This way, when conducting personalized training in the future, it can be more targeted. It can also capture the subtle details of the service and conduct quantitative assessment, summarize and analyze the core needs of customers, help institutions improve the resolution rate of problems, and the average customer satisfaction of the cooperating institutions has increased by 30%.

3. Cost Reduction and Efficiency Enhancement

Traditional manual quality inspection has significant drawbacks such as high cost and low efficiency. With the help of intelligent quality inspection, relying on the automated and intelligent processing mode, it has achieved dual optimization of cost and efficiency. This solution supports 100% full-scale quality inspection without the need for manual intervention. It can efficiently handle a large number of work orders every day, with an efficiency that is tens of times higher than the manual mode. At the same time, it reduces the cost of manual review by 30%. Moreover, it has the convenient feature of being ready to use, which can help financial institutions quickly complete deployment and implementation, significantly reducing the human cost required for operation and maintenance.

4. Data Insight Empowerment

When multiple customer service representatives handle work orders collaboratively, the unclear division of responsibilities is a long-term management problem faced by financial institutions. Instadesk Quality Inspection can precisely locate the response content of each customer service representative and the corresponding service link, and generate exclusive quality inspection reports, clearly defining the responsibility scope of each party. The system can also conduct analysis and classification annotation of work order data from multiple dimensions, extracting core information such as customer needs preferences and business process pain points. Finally, it forms an intuitive and understandable data report. These data insights can help institutions optimize product design, adjust service strategies, build a complete "data-insight-action-growth" closed loop, and help institutions effectively avoid business risks and achieve steady growth in performance. IV. Summary

The quality inspection of customer service tickets in the financial industry, as a crucial part of implementing compliance management and optimizing customer service, currently faces numerous challenges. These problems essentially stem from the fact that the traditional quality inspection model cannot keep up with the pace of digitalization in the industry. However, Instadesk will continue to be rooted in the financial sector, focusing on optimizing solutions based on the core needs of customers. Leveraging its solid technological innovation accumulation and rich solution experience, it will provide more valuable quality inspection services, comprehensively assisting the entire financial industry in achieving compliant and stable development.

Issac

Omnichannel Digital Operations: Driving Traffic Growth & Deepening User Value

You may also like

AI powered ticket prioritization system for scalable, always on service operations

With the continuous increase in cross-regional and cross-channel customer service, organizations are facing a common problem. The problem is not the number of tickets, but the unclear judgment. Requests will be entered into the system from social platforms, emails, web forms and voice channels at the same time. Some requests need to be processed immediately, and some requests can be discussed later. In many teams, priorities are still determined by manual judgment or simple rules. This method will lengthen the response time and make the processing results inconsistent.

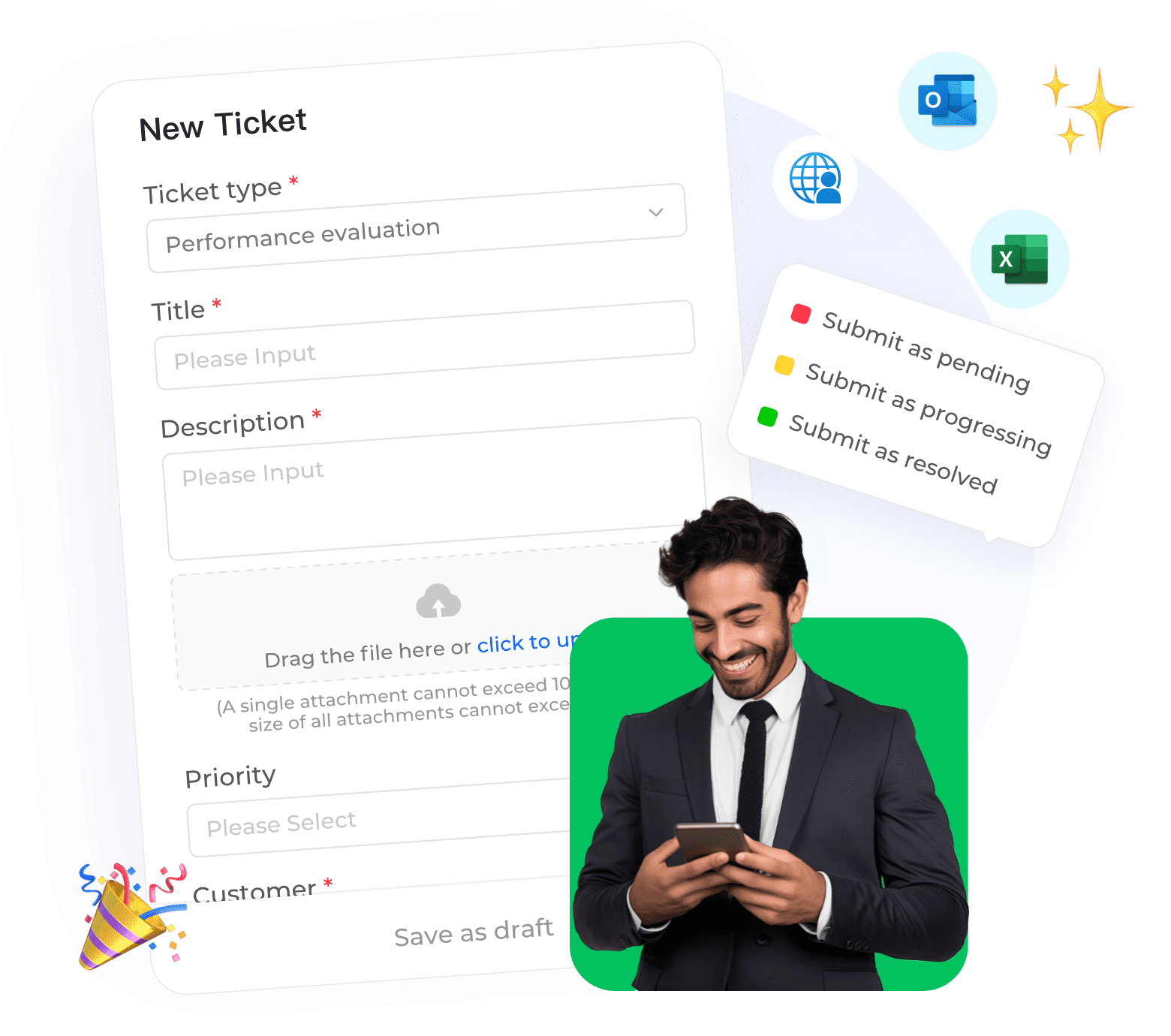

24-7 Ticket Support System with Mobile Access: Always-On Service Operations

As customer services expand across countries and time zones, organizations face growing pressure to respond faster and remain accessible beyond traditional office hours.

Automated Ticket Assignment System for Enterprise: Building Scalable Service Operations

Enterprises across Southeast Asia are experiencing a rapid increase in customer service complexity. As businesses expand into countries such as Thailand, Malaysia, Indonesia, Vietnam, and the Philippines, customer inquiries arrive through more channels, in more languages, and across multiple time zones. Traditional manual ticket handling struggles to keep pace with this growth.

Get Started in Minutes. Experience the Difference.